What to Expect After Going Under Contract on a Home in Florida

Once you’re officially under contract, the real work begins, and having a clear understanding of what comes next is critical. In Tampa’s competitive real estate market, especially in highly sought-after neighborhoods like Hyde Park, luxury homes often move quickly and come with high expectations. Being educated on the process after your offer is accepted gives you the confidence to move forward without delays or surprises.

From inspections to appraisals to final closing, every step has a deadline that could impact your financing, negotiations, or even your ability to close on time. Whether you’re a first-time buyer or purchasing your next dream home, knowing the full closing timeline helps you stay in control and protects your investment.

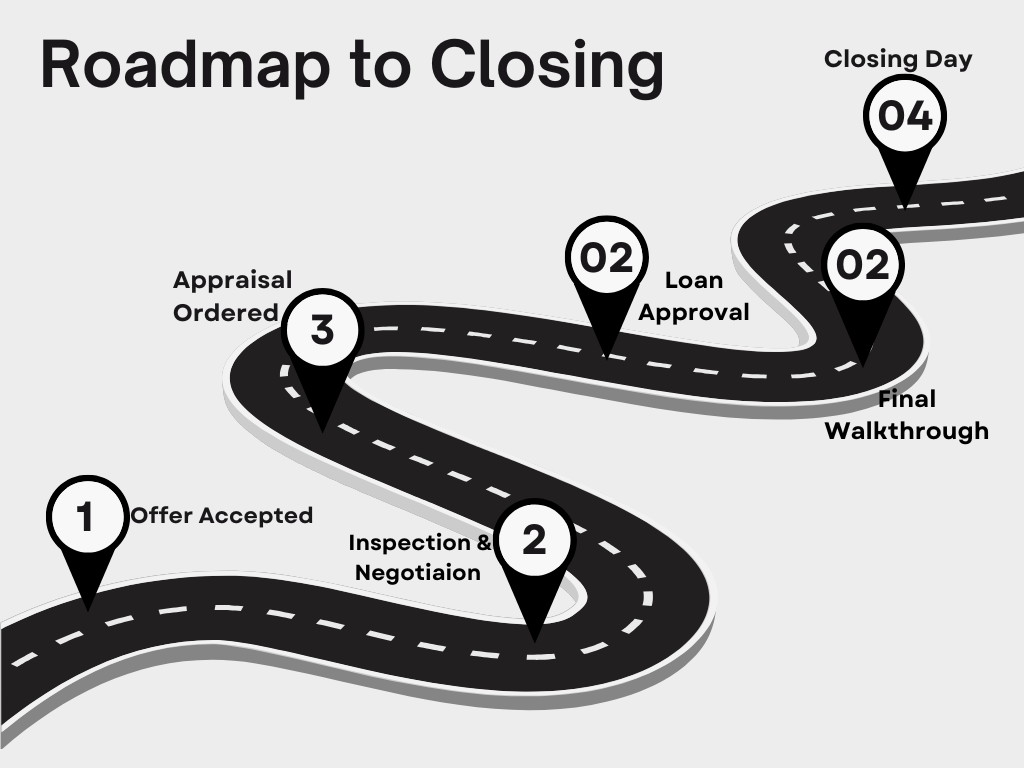

1. Offer Accepted

Once your offer is accepted, your real estate agent immediately begins coordinating next steps. You’ll sign the formal contract and typically wire an earnest money deposit (commonly 1 to 3% of the purchase price) to the title company. This shows you’re serious and officially kicks off your inspection period. A good agent will help manage the timelines and keep your transaction on schedule from day one. In luxury transactions, where contingencies and timelines are more complex, this level of precision is key.

2. Inspection & Negotiation (Days 1–10)

During this period, your home inspection is scheduled, usually within the first 3 to 5 days after contract acceptance. A licensed inspector will assess the property’s condition, from the roof and HVAC systems to plumbing and foundation. In historic neighborhoods like Hyde Park, where older homes are common, this step is especially important. If significant issues arise, your agent will negotiate with the seller for repairs, credits, or price adjustments. You’ll also be able to terminate the contract during this window if something major turns up, making it a critical checkpoint for buyers.

3. Appraisal Ordered (Days 10–15)

Once the inspection period is cleared, your lender will order an appraisal to ensure the home’s value matches the purchase price. This protects both you and the bank from overpaying. Appraisals typically take 5 to 7 days from the date they’re scheduled. In Tampa’s luxury real estate market, where unique properties are common, appraisals can sometimes be subjective, so having a knowledgeable agent who can support the value with comps is a major advantage. If the appraisal comes in low, your agent may help renegotiate or guide you through appeal options.

4. Loan Processing & Approval (Days 15–30)

After the appraisal, your file moves into final loan underwriting. During this stage, the lender verifies your income, assets, employment, credit, and property documentation. They also review the title report and homeowners insurance. Most conventional loans clear approval within 30 days, but delays can happen if documents are missing or if you’re using a specialty loan program. As your agent, I’ll be working closely with your loan officer to ensure everything is submitted correctly and that we’re always one step ahead of the closing date.

5. Final Walkthrough (Just Before Closing)

The final walkthrough is typically scheduled 24 to 48 hours before your closing appointment. It’s your opportunity to verify that any negotiated repairs were completed, confirm the property is in the same condition, and ensure nothing unexpected has changed. In luxury homes, you might be checking that appliances, smart systems, or custom finishes are functioning properly. I’ll walk through the property with you or on your behalf to ensure everything is perfect before you sign on the dotted line.

6. Closing Day (Day 30–45)

This is the finish line. On closing day, you’ll sign your final loan and title documents, submit your remaining down payment and closing costs, and officially take ownership of your new home. In Florida, closings are typically handled by a title company or real estate attorney. Once the funds are received and the paperwork is recorded, you get the keys to your new property. Congratulations, you’re officially a homeowner.

Your Partner in the Buying Process

Buying a home in Tampa doesn’t have to be stressful. With the right support, you can move through each step with clarity and confidence.

As an experienced agent with Anchor Real Estate, I guide you through the entire process, from the initial search to closing day, while connecting you with trusted inspectors, lenders, and title professionals.

You’ll always know what’s happening, and you’ll never go through it alone. Let’s talk about how I can help you find and close on the right home in Tampa.